LGM's White Paper

Mar 12, 2025

LGM´s White Paper

Unvealing The Lithium Project

The Lithium Project, formally known as Lithium Global Machines (LGM) and informally referred to as The Lithium Network, represents a pioneering venture in global blockchain innovation. Its names and identifiers reflect the project’s versatility and accessibility across different contexts:

○ Formal Full Name: Lithium Global Machines (LGM)

○ Informal Reference: The Lithium Network

○ Short Form: Lithium

The project’s currency symbol, LTH, is encouraged to be universally recognized and pronounced as “lithium” or “lithiums” when used in the plural form. It is important to note that LTH is never read as individual letters (L.T.H.), but rather as a unified term. Additionally, the identifier can also be styled in lowercase format (lgm), depending on personal or contextual preference.

Introduction

This is a no-nonsense, enterprise-grade, layer-one blockchain project, designed with the highest standards to deliver clear utility, and noteworthy value to its users. This project operates entirely without any central authority, embodying true decentralization; meaning once released not even the original creators will have any full control over the network, but rather the community gathering around it all across the globe. At its core, it features cutting-edge innovations, showcasing the incredible capability of blockchain technology.

The true worth of LGM is amplified by the global network of nodes that employ their resources to secure it, validate transactions, and mine new blocks. As a reward for their efforts in maintaining the network’s security, those who successfully mine a block receive a certain number coins in its native currency (LTH). Additionally, LGM’s breakthrough and novel solutions boost its overall merit, considering its significant potential positive impact on the world economy. Consequently, just like the original premise of Bitcoin, this is a truly nonprofit project, meaning that it won’t be running like a business per se, but rather will allow businesses to be built on top of it or around it.

In fractional expressions one Lithium is a 1 on 1 unit, one Lith is 1 half of one Lithium, a Dexlit is a 10th of one Lithium, and one Lit is a 100th of one Lithium.

This paper explores the key characteristics of this project, beginning with the E-PoW algorithm. We will analyze its distinctive features and assess its potential significance within the industry.

E-PoW

E-PoW stands for Enhanced Proof of Work. It’s a very powerful, lightweight, and Eco-friendly adaptation of the well-known proof of work consensus algorithm, backed by a Hash Engine (HE) proper to the Lithium network. It’s designed to reduce energy consumption substantially without compromising security under no pretext whatsoever. This algorithm is founded on the Absolute Zero Trust principle, or the AZT principle, which states the following:

“The system trusts no one, no one trusts no one; nonetheless, together everyone trusts the system.”

During the mining process, each new block begins with a self-referential hash, which is initially ‘headless’ and must be completed by the miners. The ‘head’ is a configurable sequence of zeros, with potential lengths of 5, 7, 9, or 11, that miners must compute correctly to mine the block successfully. Each sequence length corresponds to a target type, labeled from ‘A’ to ‘D’—for example, Type C represents a sequence of 9 zeros. These targets dictate the difficulty of the mining process, which increases with higher targets due to the slightly greater computational effort required. The level of difficulty is dynamically adjustable via the A-Equation, enabling the system to adapt seamlessly to changes in mining conditions.

Moreover, the verification and confirmation of transactions operate independently from the mining process. This parallelization ensures that these critical functions are not bottle-necked by mining activities, contributing to improved system scalability and responsiveness. By decoupling these processes, the network achieves a more balanced and efficient structure, optimizing both transaction handling and block creation.

Enters the Hash Engine (HE), whose sole purpose of the is to generate the zeros needed, one byte at a time, so that the miners can eventually assemble the head of the hash for the next block to mine. Therefore, at its most fundamental function, the Hash Engine is nonce producer. The HE is triggered once every second, producing up to two-digit numbers each time. This frequency is the same for every single node, no matter how powerful the hardware it operates on is. Consequently, that gives every miner securing the network a fair shot.

The HE produces both zeros and non-zeros single digits, the miners watch out only for the zeros. Each time a zero is produced, the miners gather it while discarding other non-zero digits, they build up a summation of zeros, keep track of them, and count them. The very first mining node to reach the target type, distributes its sequence of zeros over the network for verification and potential confirmation by the other nodes. After positive confirmation by the other peers, that node is the legitimate miner of the next block. Next, the zero count is reset to null, then the process of zeros gathering starts all over again.

The non-intensive character of the HE, which supports the E-PoW algorithm is what makes Lithium very lightweight, setting it apart for its Eco-friendliness, alongside its rock-solid performance, security and integrity. Another great advantage of this algorithm is that it also drastically lowers the type of syndromes that are typical on other networks both at hardware and a human levels; take for example the Bitcoin Node Anxiety & Stress syndrome (a.k.a., the BANS syndrome) that all nodes suffer from when trying hard and desperately to mine the next block.

The Zero Impersonation Avoidance Principle

“No one shall impersonate the zeros by tampering.”

This principle is enforced by two major factors, the proper procedure of the zeros sequence formation that will constitute the hash head and the E-PoW laws.

A.) Zeromicrochain Definition and Structure

Each sequence of zeros is meticulously constructed into a microchain known as a zeromicrochain. The length of each zeromicrochain is determined by the target type of the sequence.

Within each zeromicrochain, every zero is an immutable set of fields comprising:

- The zero itself

- A hash pointing to the hash of the previous zero

- The hash of the actual zero

- The HE (Hash Engine) signature

- The NC (Nonce Collector) signature

And finally the current microchain logs the hash of the previously created and confirmed zeromicrochain.

B.) The E-PoW Laws

The Enhanced Proof-of-Work (E-PoW) Laws are a set of guidelines designed to ensure the integrity and efficiency of nonce management within the network. These laws govern the interactions and roles of various components such as nodes, the Hash Engine, and the Nonce Collector, as well as the processes involved in the creation, validation, and distribution of nonces. By adhering to these laws, the network maintains a secure and reliable nonce supply chain, ensuring that nonces are properly authenticated and distributed.

1. Communication Restrictions: No individual node is permitted to have direct communication with either the “Hash Engine” or the “Nonce Collector.” Furthermore, no node can add or retrieve nonces directly from these two core components of the nonce supply chain.

2. Nonce Validation: A nonce can only be validated within the Publisher if it originates from the Collector.

3. Nonce Distribution: The Publisher is prohibited from signing nonces and holds the exclusive authority as the “Nonce Distributor” on the network.

4. Raw Nonce Definition: A “raw nonce,” defined as any newly created and unsigned nonce by the “Hash Engine,” is considered a useless nonce.

5. Nonce Authenticity: To be deemed authentic and useful, a nonce must be signed by its authoritative issuers and confirmed by other nodes on the network.

6. Raw Nonce Collection: There is only one legitimate raw-nonce collector, known as the “Native Nonce Collector.”

7. Signature Authority: The Native Hash Engine possesses the highest profile signature authority within the network in terms of nonce production and supply chain.

The A-Equation

Introduction to the A-Equation

The A-Equation, also known as the adjustment equation, is the ultimate ruler that governs the dynamics of Lithium mining. This equation is literally the soul of the Lithium network in terms of mining security, mining rate, and block rewards. It provides a metric for evaluating mining efficiency and adjusting the mining process to ensure optimal performance.

Definition of the A-Equation

The A-Equation is expressed as follows:

$$a=1-\left(\frac{n}{t}\right)$$

Where:

- a: The adjustment number, representing the efficiency or performance of the mining process.

- n: The number of blocks mined over a certain period.

- t: The time expressed in minutes.

- 1: The unit number, serving as the baseline for the adjustment calculation.

Importance of the Adjustment Number

The adjustment number (a) is a crucial indicator in the mining process. Ideally, this number should always be a positive rational value less than 1. A value close to 1 signifies high mining efficiency, while a value closer to 0 indicates the need for adjustments to improve performance. By continuously monitoring the adjustment number, miners can stay informed and predict the direction of the mining swing depending on the target type under which the operations are currently running.

The A-Equation’s role in dynamically adjusting mining parameters ensures that the mining process remains efficient and responsive to varying conditions, ultimately contributing to the overall health and sustainability of the Lithium network.

Application of the A-Equation in Mining Dynamics

The following scenarios showcase how the A-Equation is used to determine the adjustment numbers when transitioning between different mining types (A, B, C, D).

1. Under Type A

Changes the number of Lithium units from 4 to 6:

$$\ \ a=1-\left(\frac{n}{20}\right)$$

Adjustment numbers for Type A to increase the reward by 50% are: {0.9, 0.95, 1}.

Transition to Type B:

• Scenario 1: $$\ \ \ \ \ \ \ \ \ \ \ \ a=1-\left(\frac{3}{5}\right)=1-0.6=0.4$$

• Scenario 2:

$$a\ =\ 1\ -\ \left(\frac{6}{15}\right)\ =\ 1\ -\ 0.4\ =\ 0.6$$

Adjustment numbers for Type A to transition to Type B are: {0.4, 0.6}.

2. Under Type B

• Scenario 1: (Back to Type A)

$$a=1-\left(\frac{3}{21}\right)=1-0.14=0.86$$

• Scenario 2 (Back to Type A):

$$a=1-\left(\frac{0}{21}\right)=1-0=1$$

Adjustment numbers for Type B to transition back to Type A are: {0.86, 1}.

• Transition to Type C:

$$a=1-\left(\frac{4}{21}\right)=1-0.19=0.81$$

Adjustment number for Type B to transition to Type C is: {0.81}.

3. Under Type C:

• Scenario 1 (Back to Type A):

$$a=1-\left(\frac{3}{27}\right)=1-0.11=0.89$$

• Scenario 2 (Back to Type A):

$$a=1-\left(\frac{0}{27}\right)=1-0=1$$

Adjustment numbers for Type C to transition back to Type A are: {0.89, 1}.

• Transition to Type D:

$$a=1-\left(\frac{4}{27}\right)=1-0.14=0.86$$

Adjustment number for Type C to transition to Type D is: {0.86}.

4. Under Type D:

• Scenario 1 (Back to Type A):

$$\ a=1-\left(\frac{3}{33}\right)=1-0.09=0.91$$

• Scenario 2 (Back to Type A):

$$a=1-\left(\frac{0}{33}\right)=1-0=1$$

Adjustment numbers for Type D to transition back to Type A are: {0.91, 1}.

• Transition back to Type B:

$$a=1-\left(\frac{4}{33}\right)=1-0.12=0.88$$

Adjustment number for Type D to transition back to Type B is: {0.88}.

Significance

The adjustment numbers (a) provide a measure of efficiency and performance during mining operations. Lower values of a (closer to 0) indicate lower mining efficiency, prompting adjustments or transitions to improve performance. Higher values of a (closer to 1) suggest better mining efficiency, potentially allowing the process to remain stable or revert to a baseline state.

That’s how the A-Equation helps dynamically adjust the mining process based on performance metrics, ensuring optimal output and efficiency in Lithium mining operations.

The A-Equation in Action

By utilizing the adjustment number (a), the equation vigorously influences how the mining process shifts from one target type to another, according to the attested efficiency and performance, starting under the default target type.

Default Target: Type A

Parameters:

- One block is mined every 5 minutes on average.

- Reward: 4 units of Lithium per block.

Adjustment Scenarios:

- If after 20 minutes, fewer than 3 blocks are mined:

- The reward is set to 6 units of Lithium per block for the next 15 minutes.

- If within those 15 minutes, a minimum of 3 blocks is mined, the reward reverts to 4 units per block.

- If within 5 minutes, up to 3 blocks are mined, or up to 6 blocks within 15 minutes:

- The target changes to Type B.

Target: Type B

Parameters:

- One block is mined every 7 minutes on average.

- Reward: 8 units of Lithium per block.

- Duration: 21 minutes.

Adjustment Scenarios:

- If after 21 minutes, fewer than 3 blocks are mined:

- The target reverts to Type A.

- If no blocks are mined, the reward is set to 6 units per block for 15 minutes before returning to the normal 4-unit reward.

- If up to 4 blocks are mined before or at the end of 21 minutes:

- The target changes to Type C.

Target: Type C

Parameters:

- One block is mined every 9 minutes on average.

- Reward: 10 units of Lithium per block.

- Duration: 27 minutes.

Adjustment Scenarios:

- If up to 3 blocks are mined during the 27 minutes:

- The target reverts to Type A, rewarding 4 units of Lithium per block.

- If no blocks are mined during the 27 minutes:

- The target reverts to Type A, with the reward set to 6 units per block for 15 minutes before returning to the normal 4-unit reward.

- If up to 4 blocks are mined during or before the 27 minutes:

- The target changes to Type D.

Target: Type D

Parameters:

- One block is mined every 11 minutes on average.

- Reward: 12 units of Lithium per block.

- Duration: 33 minutes.

Adjustment Scenarios:

- If up to 3 blocks are mined during the 33 minutes:

- The target reverts to Type A, rewarding 4 units of Lithium per block.

- If no blocks are mined during the 33 minutes:

- The target reverts to Type A, with the reward set to 6 units per block for 15 minutes before returning to the normal 4-unit reward.

- If up to 4 blocks are mined during the 33 minutes:

- The target changes back to Type B, with the corresponding mining criteria.

- After Type B, the process reverts to Type A, rewarding either 4 or 6 units of Lithium per block, depending on the outcomes in Type B.

Probabilistic Estimates

Definitions and Variables

In the following section we will discuss the variables and probabilities involved in each target type prospect:

- A: Type A

- \(R_A\): Reward units for Type A (4 units per block)

- \(t_A\): Average time to mine a block in Type A (5 minutes)

- \(p_A\): Probability of staying in Type A (default)

- \(p_{AB}\): Probability of transitioning from Type A to Type B

- \(N_A \): Number of blocks mined in Type A

- B: Type B

- \(R_B\): Reward units for Type B (8 units per block)

- \(t_B\): Average time to mine a block in Type B (7 minutes)

- \(p_{BA}\): Probability of transitioning from Type B to Type A

- \(p_{BC}\): Probability of transitioning from Type B to Type C

- \(N_B\): Number of blocks mined in Type B

- C: Type C

- \(R_C\): Reward units for Type C (10 units per block)

- \(t_C\): Average time to mine a block in Type C (9 minutes)

- \(p_{CA}\): Probability of transitioning from Type C to Type A

- \(p_{CD}\): Probability of transitioning from Type C to Type D

- \(N_C\): Number of blocks mined in Type C

- D: Type D

- \(R_D\): Reward units for Type D (12 units per block)

- \(t_D\): Average time to mine a block in Type D (11 minutes)

- \(p_{DA}\): Probability of transitioning from Type D to Type A

- \(p_{DB}\): Probability of transitioning from Type D to Type B

- \(N_D\): Number of blocks mined in Type D

- T: Total time (in minutes) for the mining process over a month (30 days)

- \(T\ =\ 30\ \times24\ \times60\ =\ 43200\ minutes\)

Equations for Expected Blocks and Units of Lithium

Number of Blocks Mined in Each Type

1. Type A:

$$N_A = \frac{T \times p_A}{t_A}$$

2. Type B:

$$N_B = \frac{T \times p_{AB} \times p_{BA}}{t_B} + \frac{T \times p_{AB} \times p_{BC}}{t_B}

$$

3. Type C:

$$N_C = \frac{T \times p_{AB} \times p_{BC} \times p_{CA}}{t_C} + \frac{T \times p_{AB} \times p_{BC} \times p_{CD}}{t_C}

$$

4. Type D:

$$N_D = \frac{T \times p_{AB} \times p_{BC} \times p_{CD} \times p_{DA}}{t_D} + \frac{T \times p_{AB} \times p_{BC} \times p_{CD} \times p_{DB}}{t_D} $$

Total Units of Lithium:

$$L = N_A \times R_A + N_B \times R_B + N_C \times R_C + N_D \times R_D

$$

Probability likelihood for each type following the default type, by belief aggregation, or singleton probability distribution which helps in simplifying the application of the aforementioned equations.

• Type B: 17%

• Type C: 12%

• Type D: 6%

Given Parameters

• Total Time (T): 43,200 minutes (30 days)

• Type A:

o Blocks every 5 minutes.

o Reward: 4 units per block.

o Probability: Remaining proportion after accounting for Types B, C, and D.

Type Probabilities

• Type A Probability: $$1 – (0.17 + 0.12 + 0.06) = 0.65

$$

Number of Blocks and Lithium for Each Type

Type A

• Average Time per Block: 5 minutes

• Blocks per Month:

$$N_A = \frac{T \times p_A}{t_A}

$$

$$N_A = \frac{43,200 \times 0.65}{5} = 5,616 \text{ “blocks”}

$$

• Lithium units per Month: $$L_A = N_A \times 4$$

$$L_A = 5,616 \times 4 = 22,464 \text{ “units”}

$$

Type B

• Average Time per Block: 7 minutes

• Blocks per Month:

$$N_B = \frac{T \times p_B}{t_B}

$$

$$N_B = \frac{43,200 \times 0.17}{7} = 1,048.8 \text{ “blocks”}

$$

• Lithium units per Month:

$$L_B = N_B \times 8

$$

$$L_B = 1,048.8 \times 8 = 8,390.4 \text{ “units”}

$$

Type C

• Average Time per Block: 9 minutes

• Blocks per Month:

$$N_C = \frac{T \times p_C}{t_C} $$

$$N_C = \frac{43,200 \times 0.12}{9} = 576 \text{ “blocks”}$$

• Lithium units per Month:

$$L_C = N_C \times 10

$$

$$L_C = 576 \times 10 = 5,760 \text{ “units”}

$$

Type D

• Average Time per Block: 11 minutes

• Blocks per Month:

$$N_D = \frac{T \times p_D}{t_D}$$

$$N_D = \frac{43,200 \times 0.06}{11} = 235.64 \text{ “blocks”}

$$

• Lithium units per Month:

$$L_D = N_D \times 12$$

$$L_D = 235.64 \times 12 = 2,827.68 \text{ “units”}$$

Total Average Blocks per Month

$$N_{\text{total}} = N_A + N_B + N_C + N_D$$

$$N_{\text{total}} = 5,616 + 1,048.8 + 576 + 235.64 = 7,476.44 \text{ “blocks”}

$$

Total Average Units of Lithium per Month

$$L_{\text{total}} = L_A + L_B + L_C + L_D

$$

$$L_{\text{total}} = 22,464 + 8,390.4 + 5,760 + 2,827.68 = 39,442.08 \text{ “units”}

$$

If we further highlight the results, the:

• Total Average Blocks per Month is: 7,476.44 blocks

• Total Average Units of Lithium per Month is: 39,442.08 units

Analysis of Probabilities

1. Type A:

- Probability (65%): The mining dynamics has more tendency to sustain a consistent balance under this type, given that most operations start here and maintain stability unless the conditions change significantly. The majority of blocks mined are likely to occur in this state, ensuring a steady baseline output.

2. Type B:

- Probability (17%): This reflects a moderate likelihood of transitioning to an intermediate state when certain conditions or performance metrics are met. It’s realistic as an intermediate step between the default and more advanced types.

3. Type C:

- Probability (12%): This lower probability is a realistic transition for a more advanced state, which might require specific conditions to be met (e.g., higher performance or stability). It represents a smaller but significant portion of the total operations.

4. Type D:

- Probability (6%): This is the least likely state, representing the highest level of efficiency. It’s realistic that only a small percentage of operations would reach this state, making it the most elevated critical point possible when the network hits optimal performance.

Absolute Anonymity

The General Courier Protocol

The General Courier Protocol (GCP) is a strong anonymity mechanism designed to help individuals keep their addresses and ultimately their identities unrevealed, and untraceable while doing business on the Lithium network. It is implemented with a swap engine that has a pool of its own disposable addresses, where they keep on getting renewed as they are being used. When a transaction is being made, the GCP Protocol conceals every detail about the original address while replacing it with one of its own and considering the information needed from the destination address for proper execution and delivery of the transaction. Simply put, unless you tell someone you are the one behind the address of a certain wallet that may have previously submitted a transaction, they have no way of knowing. Only you can reveal yourself and prove who you are, they can’t prove who you are.

The GCP Protocol in Security Reinforcement

Besides ensuring absolute anonymity, moreover, the GCP Protocol adds an extra layer of security to the system. It will not process or deliver any transaction that hasn’t been fully confirmed by all the necessary nodes securing the system. It also makes sure that all transactions are rightfully conducted under the proper merit and legitimacy.

Where the GCP Protocol applies and where it does not

Even though the GCP Protocol is designed to not reveal any information about two peers involved in a transaction one way or another, strong anonymity does not always make sense, that’s why there may be some exceptions to that principle.

The following sections showcase some examples where those exceptions may apply:

Smart Contracts

Certain smart contracts may or may not require the two or more parties involved to clearly identify themselves for the sake of transparency and process validation. For instance, the ownership transfer of an asset from one owner to the next, be it physical or non-tangible.

The STINCOP Protocol

This protocol runs on a principle of transparency, therefore strong anonymity is not applicable.

Asset Registration

Asset registration will require the unequivocal rightful ownership of the property, so here, strong anonymity is also not applicable.

The DA/DCP Protocol

Strong anonymity does not fit well with this protocol either.

The DA/DPC Protocol

(Digital Address/ Digital Postal Code)

Sharing the same premise as the Absolute Zero Trust (AZT) principle, this is a communication protocol designed to share documents, and exchange messages using hardcore end-to-end encryption, where no one trusts no one, except the parties involved with nothing or no one in between. It allows the users to share highly sensitive documentation, like medical records, government top-secret official papers, confidential customers data, etc., when doing so via conventional e-mail or having a third party in the middle is not the appropriate approach under no circumstance.

The parties involved in the communication may or may not have any notion of each other, meaning that this protocol is not intended to be fully anonymous, but rather to be a secure, ultra-private, and user-friendly piece of technology that permits them to handle any type of document with the highest level of sensitivity.

Each DA/DPC account on the Lithium Network is uniquely tied to a specific node or nodeless device, ensuring individualized access and security. Upon a user’s initial creation of a DA/DPC account, it is offered free of charge for the first year, providing an accessible entry point to the network. Following this period, a yearly fee equivalent to twenty dollars in lithiums is applied, with a 4.5% year-over-year increase. This gradual fee adjustment reflects the network’s commitment to sustaining its infrastructure while remaining affordable for users.

If the system is unable to process the account fee, the account is suspended for a period of 45 days, granting the user a window to fulfill the payment. Should the payment remain unpaid, the user is given an additional 15 days to recover and export their stored data to an external medium of their choice. However, it is important to note that data exported outside the DA/DPC framework will no longer benefit from the inherent security features provided by the account. After this final grace period, the account is permanently discarded.

The funds collected through DA/DPC account fees are securely stored in a temporary wallet before being distributed to the miners responsible for maintaining and securing the network. This structure not only ensures transparency and efficiency in the management of fees but also underscores the interconnectedness of network participants in sustaining the ecosystem. By combining accessibility, security, and a structured fee system, DA/DPC accounts play a pivotal role in fostering a robust and equitable blockchain environment.

This operates independently from all other operations taking place on the Lithium network, and therefore does not compromise their anonymity at all; except for certain transactions where full anonymity would not be practical according to the parties involved.

The DA/DPC Account Standard Format

The creation of a DA/DPC account on the Lithium Network follows a strict and standardized format to ensure clarity, consistency, and security. The account structure is defined as a combination of lowercase strings, symbols, and numerical values arranged in the following formats: string, colon, numerical value; string, dot, string, colon, numerical value; and string, dash, string, colon, numerical value. Each string can contain up to 15 characters, with a maximum of four strings before the colon. The numerical value is a positive integer capped at five digits, chosen from a total pool of 111,110 unique integers. For example, some typical addresses include “alison-b:57160,” “alison.b:57160,” “john-doe:12,” or simply “lithium:1.” This standardized format also incorporates namespace management by reserving prefixes like “gov,” “org,” and “edu” to prevent impersonation of institutions.

Spam-Proof

The spam-proof mechanism further strengthens the network’s integrity. If a peer wishes to communicate with another user who has not pre-approved them on their trusted list, they must initiate contact with a “ping.” Only after the recipient replies with a “pong” confirmation can proper communication begin. If the sender tries to bypass this process, they incur a penalty fee credited to the recipient’s wallet, with the message remaining undelivered. To avoid false positives, users must confirm their intent before sending a ping request, reducing involuntary requests. It’s also worth noting that recipients have no influence over this mechanism, ensuring that they cannot manipulate the system by creating false instances of unwanted sender behavior. For the first violation, the sender incurs a flat fee of $7 (or its equivalent in Lithium units). Subsequent violations trigger percentage-based penalties calculated on wallet balance —5% for balances up to $1,000, 9% for those between $1,000 and $10,000, and 12% for balances over $10,000. A third violation leads to a 1,000-year account suspension.

Reserved DA/DPC Accounts

Certain DA/DPC accounts are reserved for sovereign entities, higher institutions, and high-profile individuals, ensuring exclusivity and authenticity. These accounts are provided free of charge and remain permanently assigned. Entities must follow correct procedures to claim their reserved accounts, preventing unauthorized usage. For example, reserved addresses for sovereign entities include “pg.gov:351,” “portugal.gov:351,” and “mexico:52.” Institutions like UNESCO and the World Bank have addresses such as “unesco:45” and “world.bank:44.” High-profile individuals like the Pope and Greta Thunberg have accounts such as “sp:33” and “greta.thunberg:133.” More importantly, entities have the option to choose between dotted or dashed formats; however, the dotted addresses are generally recommended for their more formal and professional appearance.

Clearer examples of reserved accounts

For sovereign entities

Portugal: “pg.gov:351,” “portugal.gov:351,” “portugal:351”

Mexico: “mx.gov:52,” “mexico.gov:52,” “mexico:52”

For higher institutions

UNESCO: “unesco:45”

World Bank: “wb:44,” “world.bank:44”

WHO: “who:48,” “world.health.organization:48”

James Bond Franchise: “jb:007,” “james.bond:007”

For high-profile individuals

The Pope: “sp:33,” “supreme.pontiff:33”

Greta Thunberg: “gt:133,” “greta.thunberg:133”

Satoshi Nakamoto: “sn:08,” “satoshi.nakamoto:08”

LGM official DA/DPC addresses such as “lgm:1” and “lithium.global.machines:1” are default trusted accounts for network communications such as system updates; votes on critical features, integration and policy, etc. These are used exclusively for official purposes. Conversely, forbidden accounts like “lithium:0” are explicitly excluded from registration to safeguard the network’s uprightness.

The network’s comprehensive security and compliance measures reflect its enterprise appeal, particularly for industries requiring stringent regulatory readiness. The opt-in model for communication aligns seamlessly with consent-driven environments like healthcare and finance. Additionally, revenue from penalties is redistributed directly to recipients, incentivizing users to actively monitor their security. By fostering data sovereignty principles that allow recipients full control over their trusted peers, the system upholds GDPR-like protections, emphasizing trust and transparency throughout its ecosystem. Through such structured and adaptive measures, the Lithium Network ensures that DA/DPC accounts maintain high standards of usability, security, and professionalism across all use cases.

DA/DPC Account Claim Procedure

For the rightful owners of any reserved DA/DPC accounts to claim them, a strict and transparent process is in place to ensure security and authenticity. This can be initiated using the Lithium OS or a third-party application capable of interacting with the mainnet via its SDK. During the process, claimants are required to provide official documentation as proof of entitlement. Once submitted, the system randomly and independently selects 15 miners to review and confirm the claim. These miners operate without knowledge of each other’s tasks or identities, ensuring an unbiased and tamper-resistant process. After successful verification, the rightful owners gain full access to their accounts.

The verification process is streamlined for efficiency, with a maximum completion time of 72 hours. Strict guidelines, documented in detail, ensure miners adhere to procedural standards. Should any miner fail to meet the deadline, they are promptly removed from the verifier pool and forfeit the opportunity to earn additional perks. Defaulted miners are immediately replaced by others to continue fulfilling the mission. A temporary yet thoroughly integrated and rigorously tested system-wide smart contract autonomously redacts raw data prior to its transmission to miners’ nodes. This mechanism effectively restricts unnecessary access to sensitive documents, thereby mitigating the risk of data exposure or leaks.

The system is fortified by tamper-resistant features, such as hashing submitted documents on-chain to create immutable records. This allows for future audits in case of need, while preserving user privacy. Additionally, penalties deter misconduct—miners approving fraudulent claims risk reputational damage and slashing of their staked LTH. Mishandling sensitive documentation carries similar consequences, potentially reducing mining rewards and perks.

This robust framework exemplifies the Lithium Network’s commitment to security, transparency, and accountability. By combining automated safeguards, independent verification, and immutable records, the process ensures that reserved accounts are claimed and managed with the highest standards of reliability and trustlessness.

DA/DPC Access Control

Accessing a DA/DPC account on the Lithium Network relies on an advanced, multi-layered security protocol tailored to guarantee both data protection and user integrity. To initiate access, users must employ a unique passkey, serving as a string-based alias, along with a tightly associated seven-digit pin. This pairing lays the foundation for robust account security, ensuring that each account remains individually protected and uniquely identifiable within the network.

To further enhance security, the system enforces escalating lockout measures for failed login attempts. After three unsuccessful attempts, users are temporarily locked out for three hours. A second series of three failed attempts extends the lockout to six hours, and a third set results in a 48-hour lockout. The same stringent measures apply to the secondary PIN layer to ensure consistent protection at every access point. At the protocol level, rate-limiting is enforced to mitigate brute-force attempts, while abnormal login patterns are actively monitored. Additionally, users may bypass PIN-based authentication entirely by opting for biometric authentication, a feature conveniently offered through LGM-OS.

Following successful login after a lockout, users are required to update their digital signature to regain full account functionality. This process involves providing two of the three passphrases they originally set when creating their account, reinforcing access control while allowing subsequent operations to resume securely.

Once access is granted, a secondary encryption layer adds an additional five-digit pin requirement to unlock sensitive data and account functionalities. This secondary pin is vital for executing high-risk actions, such as fund transfers, digital signatures, smart contract deployments or updates, and DA/DPC data modifications. While users may opt to make this secondary pin optional, such an approach is discouraged, as it weakens this critical security measure.

To ensure continuous protection, the system enforces a default passkey update interval of 45 days. Users have the flexibility to extend this interval to 60, 90, or a maximum of 105 days. However, the system issues escalating security warnings if longer intervals are chosen, reminding users of the associated risks. Institutional accounts, by design, face stricter restrictions on extending update intervals to reflect their heightened security requirements.

This thoroughly designed framework exemplifies the Lithium Network’s unwavering commitment to securing user accounts. By combining stringent login protocols, dual encryption layers, innovative biometric options, and adaptable passkey update cycles, the system provides a secure yet versatile environment. Its foundational principles of protection and adaptability underscore a relentless dedication to balancing usability with uncompromised data security.

DA/DPC protocol security aspects at a glance

| Security Aspect | Mechanism | Purpose | Example |

|---|---|---|---|

| Account Structure | Unique syntax: string:num, string.string:num, or string-string:num | Prevent spoofing via standardized, collision-resistant addresses | mx.gov:52 (Mexico), john-doe:12 |

| Encryption | Post-quantum cryptography/AES-256 (data at rest) + SHA-3 (hashing) | Rock-solid protection for sensitive data (e.g., medical records) | Encrypted payroll data in LGM-PR |

| Zero-Knowledge Proofs (ZKPs) | Privacy-preserving validation of transactions/audits | Balance transparency with confidentiality for regulated industries | Tax audits without exposing employee salaries |

| Anti-Spam (Ping/Pong) | Penalty fees (5–12% of wallet balance) + 1,000-year suspension for repeat offenses | Deter unauthorized communication and Sybil attacks | Spam message blocked; sender penalized $7 or 12% of wallet |

| Multi-Layer Authentication | Passkey (string alias) + 7-digit PIN; secondary 5-digit PIN for high-risk actions | Protect against credential theft and unauthorized access | Biometric login via LGM-OS for fund transfers and other operations |

| Passkey Rotation | Mandatory 45-day updates (extendable to 105 days with warnings) | Mitigate long-term credential compromise | User updates alison-b:57160 passkey every 45 days |

| Reserved Account Claims | 15 miners review hashed documents; tamper-resistant smart contracts | Ensure only verified entities (governments, institutions) claim reserved IDs | wb:44 (World Bank) validated via encrypted legal docs |

| Miner Accountability | Slashing staked LTH for approving fraudulent claims or mishandling data | Enforce honest behavior during reserved account verification | Miner loses stake for approving fake sp:33 (Pope) claim |

| Data Redaction | Sensitive documents hashed before miner review | Preserve privacy during verification | Unnecessary data hashed for unesco:45 claim |

| Rate-Limiting | Login attempt lockouts, System-wide rate monitoring | Prevent abuse of system features | User locked out after 3 failed PIN tries |

| Immutable Audit Trail | On-chain hashing of all verification records | Create permanent, tamper-proof proof of compliance | Hashed proof of mexico.gov:52 stored publicly |

| Lockout Escalation | 3 failed logins → 3-hour lockout; subsequent failures → 6h, then 48h | Deter brute-force attacks | Account locked for 48h after 9 failed PIN attempts |

| Non-Transferable Reserve | DA/DPC accounts cannot be transferred to third parties | Protect institutional identities (e.g., jb:007 for James Bond Franchise) | supreme.pontiff:33 remains exclusive to the Vatican |

Volatility Proofing

Çollid

Protection against market instability

Volatility Proofing Çollid (Ç) acts as a specialized reserve currency within the Lithium ecosystem, providing users with a safeguard against the unpredictable fluctuations of bear markets. Represented by “Ç” (always in its capital format), this currency is designed as a protective mechanism, allowing users to shield their Lithium assets during periods of instability. By design, Ç is not directly transferable between peers under ordinary circumstances. For instance, if a user wants to send an amount equivalent to Ç2 to another but lacks available Lithium in their wallet, they must first convert Çollid back into Lithium to complete the transaction. While exceptions may apply in extraordinary circumstances, the primary role of Ç remains as a reserve asset.

Protection Against Market Instability

Here’s how it works: Imagine that one Lithium is currently worth $5, and you hold 4 Lithiums, valued at $20. As the market becomes volatile, the price of Lithium begins to decline—to $4.98, then $4.95, and eventually $4.93. By the time Lithium reaches $4.90, your holdings have decreased to $19.60 from the original $20. Concerned about further losses, you decide to convert your holdings into Ç, placing them in reserve mode to safeguard their value until the market stabilizes.

Over time, as the market continues to fluctuate, Lithium’s price drops further, eventually losing $0.50 in total and settling at $4.50. Had you not moved your assets to Ç, your 4 Lithium units would now be worth just $17.60. However, since they were protected in reserve mode, their value remains locked at $19.60. Once the market begins to recover, Lithium’s price starts to climb, eventually reaching $4.87. Feeling confident in the market’s direction, you decide to convert your Ç reserves back to Lithium. At this new rate, your $19.60 translates to approximately 4.024 Lithiums, slightly more than the original 4 units you held. This demonstrates the strategic advantage of using Çollid during market instability.

Notably, there are no fees for transferring assets into or out of reserve mode. However, each account or wallet is restricted to performing such operations only once within a 24-hour period, ensuring controlled and deliberate usage.

Çollid Reserve Dynamics

Initially, Ç is valued at $1.0005 per Ç1.0000, but this equivalence evolves with the performance of Lithium in the market. The system dynamically adjusts Ç’s value, requiring more USD to match its equivalent as Lithium’s market strength grows. Entering reserve mode involves precise calculations to determine both the Çollid percent increase (Çpi) and the Lithium quantity (Lq). These calculations are defined as follows:

Çollid percent increase:

Where: Çpi = Çollid percent increase, Lfp = Lithium final price, Uie = US dollar initial equivalent of Ç.

Lithium quantity in reserve:

Where: Lq = Lithium quantity, Ta = Total amount (in USD), Lfp = Lithium final price.

When users decide to return to the market, the following equations are applied to ensure proper asset reallocation:

Total amount in reserve:

Lithium quantity based on market price:

Where: Lcp = Lithium current price.

These automated, on-demand calculations are seamlessly conducted at the protocol level under highly secure guardrails. Their purpose is to align with real-time market conditions, track Lithium’s performance throughout conversion cycles, and guarantee that users regain a Lithium quantity corresponding to the value initially placed in reserve. Users only need to choose “reserve” or “exit” mode and select the desired quantity to transition. While the availability of this feature is a key advantage of the network, users are neither required to perform the calculations themselves nor to have any detailed knowledge of them, in fact, they will mostly not even be aware of them. Instead, the protocol independently handles these operations with precision, adapting dynamically to real-time market data to ensure efficiency and accuracy. By offloading these complexities to the system, the user experience remains intuitive and streamlined without sacrificing the technical rigor underpinning the process.

Potential Liquidity Constraints and Mitigation

One key limitation of Ç is its non-transferable nature, which may reduce its appeal as a tradable asset compared to stablecoins like USDC. To address this, the Lithium ecosystem incorporates specialized smart contracts that enable limited Ç lending for enterprise-level use cases. For instance, businesses can use Çollid as collateral for loans. This strategic functionality broadens Ç’s usability while preserving its essential role as a reserve currency.

Strategic Value and Design

Unlike other assets, Ç is not pegged to fiat currencies; the US dollar is referenced solely as an initial benchmark. The true value of Ç lies in its ability to safeguard Lithium assets during volatile market conditions. Furthermore, Ç is neither mined nor subject to inflation. Its supply adjusts inversely to the circulating quantity of Lithium, ensuring rarity and stability. By acting as a constant unit, Ç mirrors market movements while anchoring its value in alignment with Lithium’s performance. This careful design makes Ç a reliable tool for asset preservation and market stability, empowering users with confidence during times of uncertainty.

Differentiation

| Feature | COLLID (Ç) | STABLECOINS (USDC) | WRAPPED BTC (WBTC) |

|---|---|---|---|

| Volatility Protection | Dynamic LTH-linked reserve | Fixed 1:1 fiat peg | No protection (BTC volatility) |

| Transferability | Restricted (collateral-only) | Fully tradable | Fully tradable |

| Fees | Free conversions | Minting/redeem fees | Custodial fees |

| Institutional Use | Collateralized loans, cooldown periods, Smart Contract-based | Compliance overhead | Limited to DeFi/speculation |

Common Transaction Fees

The STINCOP Protocol

Beyond speed, STINCOP offers significant scalability, allowing the system to handle increasing demands seamlessly, ensuring consistent performance even during peak times. This scalability, combined with a high transaction throughput, enhances the reliability and resilience of the service, minimizing the risk of bottlenecks and downtime. Additionally, the protocol’s competitive fee structure—charging up to 0.35% per transaction—provides exceptional cost-effectiveness. This combination of rapid transaction times and reasonable fees makes the STINCOP protocol an attractive option for financial institutions, ensuring high user satisfaction and trust while maintaining a competitive edge in the market.

By delivering faster transaction times compared to traditional methods and maintaining a mid-range fee structure, STINCOP appeals to users who require urgent transactions. Its innovative approach to transaction processing, scalability, and cost-efficiency ensures long-term success, fostering innovation and compliance, and future-proofing businesses in the dynamic financial landscape.

Other Prominent Features

| Feature | Mechanism | Reason | Use Case |

|---|---|---|---|

| Stakeholder Support | Serves investors, exchanges, brokers, clearinghouses, and treasury entities. | Streamline operations for regulated financial actors. | Investment banks execute securities settlements via smart contracts. |

| Smart Contract Automation | Customizable contracts for asset management (e.g., compliance, escrow). | Reduce manual errors in transactions (e.g., bond issuances). | Broker automates dividend distributions to shareholders. |

| Transaction Fees | Flat $0.30 fee per financial operation (e.g., account management, trades). | Stand strong vis-a-vis legacy systems (e.g., DTCC, SWIFT) on cost. | Exchange pays $0.30 to settle $1M in securities. |

| Compliance Integration | Enforces AML/CTF checks via miner reviews and DA/DPC encryption. | Align with regulations (e.g., GDPR, SEC). | Treasury submits encrypted audit trails for SEC compliance. |

| Hierarchical Wallets | E-wallets (inter-bank) → S-wallets (internal/external) → R-wallets (reserves). | Segregate roles and protect reserves (e.g., Çollid). | Clearinghouse uses E-wallet for settlements, S-wallet for internal transfers. |

| Auditability | On-chain logging of all transactions and compliance proofs. | Enable regulatory audits and dispute resolution. | SEC audits JPMorgan’s STINCOP transactions via hashed records. |

| Security | Quantum-resistant cryptography/AES-256, ZKPs, and miner-enforced policies. | Protect high-value operations (e.g., $50k+ transfers). | Built-in mechanism to enforce smart contracts standards. |

| Scalability | 5M TPS capacity for financial operations. | Handle peak loads (e.g., Black Friday trading spikes). | Process 1B securities trades/day at $0.30 each. |

| Reserve Integration | R-wallets convert LTH to Çollid for volatility protection. | Hedge institutional assets during market downturns. | Bank of Japan converts $500M LTH to Çollid during a crypto decline. |

STINCOP Account Acquisition Procedure

Account Suspension Procedure

Appeal Mechanism Overview

| Feature | Mechanism | Purpose | Example |

|---|---|---|---|

| Wallet Types | E (Enterprise): For inter-bank transfers. S (Solo): For internal/external transactions. R (Reserve): Converts LTH to Çollid. | Specialized roles for liquidity management, security, and volatility protection. | Bank of Portugal uses E-type (associated with any DA/DPC account of their choice; e.g., pg.gov:351) to send $10M to a partner institution. |

| Transaction Speed | 5 million TPS; 300 million transactions/hour. | Great alternative to other systems like SWIFT while offering decentralization. | Cross-border payroll processed in seconds. |

| Payment Orders (POs) | $0.15 fee per PO; automated execution between institutions. | Low-cost, high-volume transaction instructions for banks. | Citibank issues 1,000 POs for client transfers at $0.15 each. |

| Account Acquisition Fees | Primary Account: $2,500 one-time fee. Branch Accounts: $1,500/year. | Fund protocol maintenance and miner incentives. | HSBC pays $2,500 for its main STINCOP account. |

| AML/CTF Compliance | Miner review of legal docs (e.g., commercial register, sworn statements). | Ensure only compliant institutions join the network. | Miners verify accounts application against anti-money laundering laws. |

| Suspension & Appeal | Phase 1: 21 peers review suspicious activity. Phase 2: 17 peers audit Phase 1. Appeal: 7 peers vote (4-3 majority). | Prevent fraud while allowing fair dispute resolution. | Suspended account appeals with evidence of compliance. |

| Evidence Integrity | DA/DPC-encrypted submissions; cryptographic hashing and timestamps. | Tamper-proof audit trails for disputes. | Proof of AML compliance hashed on-chain during appeal. |

| Decentralized Governance | Miner voting on contract upgrades; peer-reviewed appeals. | Align network evolution with institutional needs. | Maintains true decentralization with miners at its core, encourages due process without compromising security, quality or timely response for urgent needs. |

| Reserve Conversion (R Wallet) | Converts LTH to Çollid (non-transferable reserve asset). | Hedge against LTH in case of volatility. | Bank of London converts $1B LTH to Çollid during a market downturn. |

| Hierarchical Account Management | Primary account controls branches; role-based permissions. | Streamline multi-department/branch operations. | JPMorgan’s main account (optionally associated with jpm:96, or any other of the same type ) manages 50 branch accounts. |

| Automated Fee Enforcement | Unpaid fees trigger 45-day suspension; data recoverable via DA/DPC for 17 days. | Ensure accountability without data loss. | Suspended institution regains to accounts functionalities after paying $1,500 branch fee. |

The Midcross Protocol

For early adopters, the protocol extends an exclusive opportunity: the first 150 users can migrate Bitcoin assets to the Lithium network without incurring smart contract fees, provided their transfer remains below half a Bitcoin. Beyond this limit, conversions up to one Bitcoin are subject to a nominal fee of 0.37%, while transfers exceeding one Bitcoin incur a slightly higher fee of 0.50%. These rates apply exclusively to total Bitcoin-to-Lithium conversions, offering clear and competitive terms for users seeking full asset migration.

The SCT algorithm further enhances the protocol by introducing a collateralized partial conversion feature. Users can leverage their Bitcoin holdings as collateral to access Lithium units without committing to a complete conversion. This option is available at a straightforward annual percentage yield (APY) of 3.5% simple interest, with the original Bitcoin assets remaining secure and fully recoverable upon repayment. For these transactions, fees are set at 0.40% for amounts up to one Bitcoin and 0.55% for larger transfers, enabling a flexible approach for those who wish to retain ownership while utilizing their Bitcoin resources. Additionally, the protocol enforces a requirement that the collateralized Bitcoin amount exceeds the corresponding Lithium request by at least 12%, ensuring robust risk mitigation.

When users opt to exit the Lithium network and revert to Bitcoin, the Midcross Protocol conducts an automated verification process to ensure the assets are free from debts or obligations. If no issues are detected, the corresponding Bitcoin amount is promptly released to the user’s wallet. This process operates seamlessly and automatically without requiring miner intervention, rendering it exceptionally swift and independent of external dependencies.

As a one-way conversion framework for full transitions, the Midcross Protocol facilitates seamless migration from the Bitcoin blockchain to the Lithium network. Its forward-thinking fee structure and SCT-driven features reinforce Lithium’s commitment to advancing blockchain interoperability and providing users with flexible tools for diversifying their digital portfolios. By addressing the core challenges of cost, efficiency, and accessibility, this initiative reflects Lithium’s dedication to remaining at the forefront of innovation in the dynamic cryptocurrency landscape.

| Feature | Mechanism | Reason | Example |

|---|---|---|---|

| Native BTC → LTH Conversion | One-way migration via smart contracts; fees: ○ First 150 users: 0% (≤0.5 BTC). ○ 0.5–1 BTC: 0.37%. ○ > 1 BTC: 0.50%. |

Facilitate adoption with Bitcoin liquidity while monetizing large institutional conversions. | Convert 5 BTC → LTH equivalent (minus the 0.50% fee). |

| Collateralized Partial Conversion | Borrow LTH against BTC (12% over-collateralization). Interest: 3.5% APY. Fees: 0.40% (≤1 BTC), 0.55% (>1 BTC). |

Enable BTC-backed liquidity for institutions without selling Bitcoin. | Hedge fund borrows 30M LTH using its BTC counterpart as collateral. |

| Automated Exit Liquidity | Protocol checks debts/obligations; releases BTC if cleared. Fees mirror entry (0.40–0.55%). |

Eliminate unnecessary miner involvement; enable seamless BTC reconversion. | User converts 100 LTH → BTC automatically (no miner visibility). |

Smart Contracts on the Lithium Network

General Smart Contracts

DApps Smart Contracts

Dapps SCs cater to specific application-related scenarios such as governance & voting, energy & utilities, transportation, environmental agreements, identity & authentication, partnership agreements, subscription services, and gambling & betting. These contracts streamline complex processes, enhance transparency, and ensure efficient management of resources and operations across multiple sectors, leveraging the power of decentralized applications (DApps) for improved functionality.

Special SCs

Special SCs are tailored for specialized financial instruments and tokenization. This category includes debt instruments, equity instruments, employee stock options (ESOs), derivatives, securitization, insurance contracts, automated market makers (AMMs), and ETFs. Additionally, it supports tokenized assets, NFTs, and various types of DAOs such as protocol, investment, social/community, grant, collector service, and slicers or subDAOs. DeFi solutions within this category encompass decentralized exchanges (DEXs), lending & borrowing protocols, yield farming & staking, synthetic assets, stablecoins development and deployment, insurance protocols, prediction markets, and cross-chain bridges. These smart contracts bring advanced financial mechanisms to the forefront, enabling seamless integration and management of digital and traditional assets.

Futures Contract for Miners

Çollid-backed Smart Contracts

Çollid, the underlying reserve currency that makes Lithium volatility-resistant, can be used as collateral for certain smart contracts. This feature significantly enhances the stability and security of transactions on the Lithium network. By leveraging Çollid as collateral, users can ensure that their smart contracts are backed by a stable asset, reducing the risks associated with price fluctuations. Whether the smart contract involves digital or physical assets, on-chain or real-world obligations, novel or traditional financial instruments. This not only provides confidence to participants in the ecosystem but also facilitates more secure and reliable financial operations. The seamless use of Çollid as collateral out of the box demonstrates the proactive approach of the Lithium network in incorporating advanced financial mechanisms to create a resilient blockchain environment.

Smart Contracts Size

The Lithium network allows general and special smart contracts to be up to 100 KB per deployment, providing ample space for developers to implement a wide range of functionalities. For DApps smart contracts, the limit is extended to 350 KB per deployment, accommodating more complex application-related scenarios and enhancing their capabilities. This design ensures that both general-purpose and application-specific contracts can be deployed effectively within the network’s framework.

Moreover, Lithium offers the flexibility to modularize larger smart contracts. This means that even if a contract exceeds the specified size limits, developers can break it down into smaller, more manageable modules. These modules can then be deployed separately and interact with each other seamlessly, ensuring that the full functionality of the contract is retained. This modular approach not only enhances the scalability of the network but also simplifies the development and maintenance of intricate smart contracts, making the Lithium network a more versatile and developer-friendly platform.

Smart Contracts Cost, Maintenance & Temporality

SCs Technicality

A separate technical documentation will provide a comprehensive, step-by-step guide on how to compose and deploy smart contracts (SCs) on the Lithium network. This detailed resource will outline the standards and best practices for creating smart contracts, ensuring that both novice and experienced developers can efficiently navigate the process. By offering clear instructions and practical examples, the documentation aims to simplify the deployment of smart contracts, enabling users to leverage the full potential of the Lithium network with confidence and ease.

Mining Reward & Perks

In addition to the primary mining rewards discussed under the target types when studying the A-Equation, miners receive several generous perks. These include transaction fees, smart contracts and their maintenance fees, DA/DPC accounts fees, STINCOP accounts acquisition and maintenance fees, among others. All these fees are kept in a temporary tamper-resistant wallet awaiting the miner who successfully mines the next block. Once this is accomplished, these accumulated fees, along with the principal mining rewards, are delivered to the miner’s actual wallet. This process ensures that miners are incentivized and rewarded not only for their mining efforts but also for their contributions to maintaining and securing the network.

Mining Rate

For a detailed recap on the mining rate, please refer to the section where we highlighted the A-Equation. This section provides comprehensive information on how the mining rate is determined and the factors that influence it.

Supply Limit

The Lithium network will have 90,000,000 premined units, each set at an initial price of $ 0.43. However, the total all-time supply is capped at 2.5 billion Lithium units. The network will produce an average of 7,476.44 blocks per month, resulting in an average of 39,442.08 units of Lithium generated monthly. This controlled supply mechanism ensures a stable and predictable issuance of new units, contributing to the overall stability and long-term sustainability of the network.

Bonus

After being released to the general public, the first 50 couples to get married on the Lithium Network via smart contracts will receive a generous courtesy of $10,000 each in LTH for honeymoon expenses. This initiative aims to celebrate and incentivize the use of blockchain technology for significant life events.

How it works

Eligibility Criteria for the Bonus Program

To qualify for this bonus program, couples must fulfill specific conditions, emphasizing their commitment and alignment with the program’s objectives. Applicants must be first-time couples, having never been married in any prior relationship. If they do not have children, they must clearly express their willingness to potentially have children in the future, either biologically or through adoption. Additionally, both individuals must be no older than 45 years of age and must not have been registered as married in any jurisdiction worldwide.

As part of the application process, couples must provide a sworn statement, digitally signed by both parties. This declaration must include clear and accurate information about their identities and other relevant details. Meeting these criteria ensures eligibility for the program, granting access to its unique benefits. However, couples failing to meet these requirements will automatically be disqualified.

Exceptions for General Network Usage

It is important to note that these prerequisites apply exclusively to those seeking participation in the bonus program. Couples merely wishing to utilize the network’s capabilities to formalize their contracts, without aiming to benefit from the bonus program, are not subject to these conditions. This flexibility highlights the system’s adaptability, accommodating a wider range of users while maintaining the wholeness of the incentive framework.

After the last Block

Benchmark

Transaction Speed

Energy Consumption

The Green Philosophy

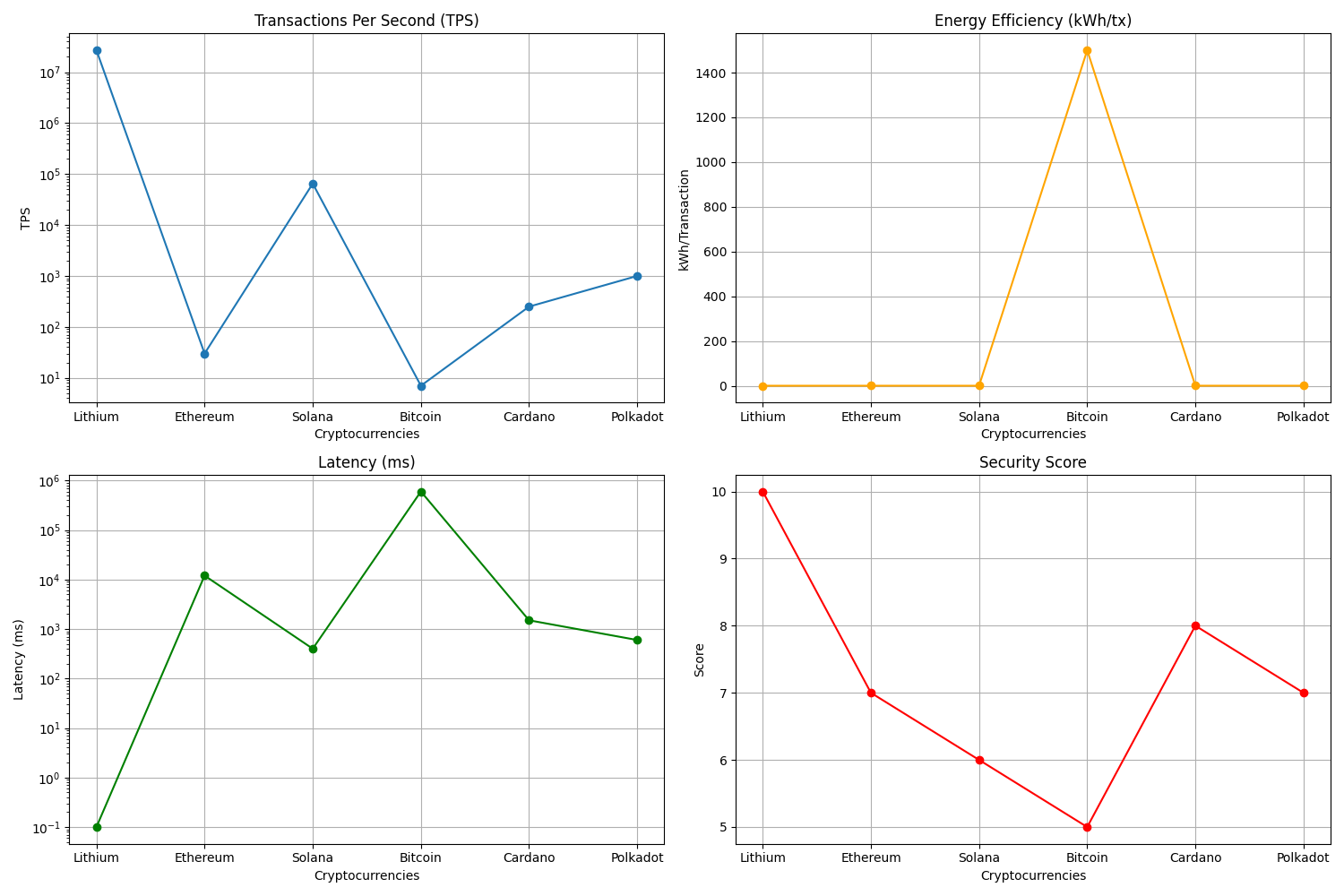

Bitcoin’s energy-guzzling Proof of Work (950 kWh per transaction) and Ethereum’s improved-but-still-modest PoS (0.000057 kWh per transaction) pale in comparison to Lithium’s near-zero energy footprint: a staggering 0.0000000897 kWh per transaction.

That’s 99.99999% more efficient than Bitcoin and 99.84% more efficient than Ethereum. Lithium’s Enhanced Proof of Work (E-PoW) isn’t just sustainable—it’s a blueprint for a future where blockchain aligns with planetary boundaries and care.

| METRIC | LITHIUM | BITCOIN | ETHEREUM | SOLANA |

|---|---|---|---|---|

| Speed (TPS) | 27,000,000 | ~7 | ~1,000 | ~65,000 |

| Energy/Tx (kWh) | 0.0000000897 | ~950 | ~0.000057 | ~0.000001 |

| Consensus | E-PoW | PoW | PoS | PoH |

| Scalability | Planetary Scale | Limited | Moderate | High |

Why the Industry Should Care

The future of blockchain isn’t just about doing more—it’s about doing more responsibly. For enterprises, this means substantial cost savings, slashing cross-border payment fees from 3% to just 0.35% per transaction. Sustainability is also a key focus, with Lithium enabling organizations to meet ESG mandates using a blockchain that consumes less energy than a lightbulb. Furthermore, enterprises can innovate by building hyper-scalable dApps, encompassing IoT, DeFi, and the metaverse, all without compromising performance.

For developers, Lithium offers a no-compromises approach, allowing them to code on a network that is both fast and environmentally friendly. The modular architecture and massive 27 million transactions per second ensure that projects will remain scalable and not outgrow the technology. For the planet, Lithium’s commitment to carbon neutrality demonstrates that blockchain can scale effectively while preserving the environment for future generations.

The Lithium Imperative

The market is evolving, with industries demanding solutions that prioritize speed, efficiency, and sustainability without compromising security or scalability. Lithium’s architecture meets these needs through a unique convergence of performance and responsibility, achieving speeds of up to 27 million transactions per second (TPS) with near-zero energy consumption (0.0001 kWh per transaction) and sub-millisecond latency. Grounded in quantum-resistant cryptography, zero-knowledge proofs, and adaptive workflows, Lithium provides a scalable foundation for real-time global finance, trillion-device IoT networks, and decentralized systems where trustlessness is inherent, inclusive, and environmentally responsible. By aligning technical excellence with long-term sustainability, Lithium enables innovation that anticipates tomorrow’s challenges.

The question shifts from “Why Lithium?” to “What can you build with it?”

Metrics Snapshot:

Lithium: Built for Security, Designed to Endure.

Lithium Robust Security Mechanism

| Measure | Traditional Blockchains | Lithium Network |

|---|---|---|

| Node Authorization | Open participation (risks Sybil attacks) | Permissioned via cryptographic signatures |

| Attack Response | Reactive (post-attack fixes) | Proactive (real-time throttling) |

| Volatility Management | Relies on external stablecoins | Native reserve currency (Çollid) |

| Post-Mining Incentives | Security declines after block rewards | Lifetime rewards for active nodes |

The Lithium Difference: Security Without Sacrifice

The Lithium Network stands out by merging advanced encryption techniques, a modular architecture, and a forward-thinking approach to tackle blockchain’s most daunting issues. With a foundation built on security and a focus on adaptability, Lithium aims to provide a resilient, scalable, and sustainable ecosystem that addresses the needs of today while anticipating future uncertainties.

A key strength of the Lithium Network is its robust security framework, which leverages quantum-resistant algorithms such as NIST lattice-based cryptography and Zero-Knowledge Proofs (ZKPs) to secure transactions and data. The use of the DA/DPC protocol ensures end-to-end encryption using AES-256 and SHA-3 standards, thereby protecting communications without sacrificing transparency. Additionally, the network’s capacity for high throughput and low latency is achieved through optimized cryptographic workflows and parallel processing, allowing it to handle speeds of up to 27 million transactions per second with sub-millisecond latency, even under global demand.

In terms of decentralization, the network employs signature-based participation to maintain reliability without relying on centralized gatekeepers, while reputation systems, strict and unequivocal slashing mechanisms mitigate insider threats. The adaptability of the network is further showcased in its smart contract flexibility, where rules can dynamically adjust to ensure resilience under pressure, and its built-in compliance features, such as KYC/AML checks and STINCOP integration, cater to regulated industries. Overall, Lithium’s strategic approach harmonizes rigorous security, scalable performance, and regulatory foresight to offer a practical solution for current challenges while preparing for future demands.

Early Official Implementations

Following its release, the Lithium Foundation will introduce four highly complex and distributed applications built on the network. This initiative will leverage the LGM’s capabilities through smart contracts, highlighting the vast potential it offers. These are external implementations built atop the Lithium Network, designed to demonstrate the extensive range of applications and innovations that can be achieved within this advanced blockchain ecosystem.

Payroll Application

One of these early applications is the payroll app for local or overseas employees, named LGM-PR. This app boasts low maintenance and transaction fees and is exclusive to companies. Its core features include comprehensive employee management, time and attendance tracking, payroll processing, tax and compliance support, benefits management, direct deposit and payment integration, reporting and analytics, security and privacy measures, a user-friendly interface, and scalability.

In terms of employee management, the app efficiently handles the collection of basic personal information, employment details, payroll setup, documentation, digital signatures, training and orientation during the onboarding process. It also provides essential features such as clock-in and clock-out functionalities, leave management, overtime tracking, and automated payroll calculation. Additionally, it offers robust tax and compliance tracking, benefits management, and various payment methods with default and native paychecks issuance through LTHs. The app’s reporting and analytics tools, secure user authentication, data encryption, and role-based access control further enhance its functionality. With its responsive design, the app ensures ease of use across multiple devices and supports cloud-based scalability to accommodate growing business needs. Bonus features include an employee self-service portal, alerts and notifications, customization options, and payment automation, making LGM-PR an efficient and user-friendly payroll solution that does not shy away from companies growth.

PoS Application

The second application is a Point of Sale (PoS) app named LGM-PoS. This app is designed to streamline and enhance the sales process for businesses, with a focus on efficiency, scalability, and user-friendliness.

LGM-PoS handles sales transactions seamlessly, supporting various payment methods such as credit/debit cards, cash, Lithium transactions and digital wallets. It features advanced QR code scanning for instant payments, ensuring a smooth customer experience. The app also excels in inventory management by tracking inventory levels in real-time, providing alerts for low stock, and integrating with suppliers for automatic reordering.

Customer management is another key feature, allowing businesses to maintain customer profiles with purchase history, manage loyalty programs and rewards, and run targeted promotions and marketing campaigns. The app offers comprehensive reporting and analytics, including sales and inventory reports, performance metrics, and visualizations.

Employee management capabilities include user roles and permissions, tracking employee sales and performance, and time clock functionalities. LGM-PoS also provides customizable receipt templates, theme settings, digital receipts, and printing capabilities, ensuring that all aspects of receipt management are covered.

For tax and compliance, the app automates tax calculations the users can set up based on local regulations, generates tax reports, and tracks compliance with applicable laws. Security and privacy are prioritized with secure user authentication, data encryption, and role-based access control. The user-friendly interface is intuitive and responsive, making it accessible on multiple devices, and the cloud-based infrastructure ensures scalability and robust performance under load.

Advanced features of LGM-PoS include an offline mode for processing transactions without an internet connection, with automatic synchronization once back online. It also supports multi-store management, allowing centralized management for businesses with multiple locations, and offers customizable interfaces to tailor the user experience to specific business needs. Additionally, LGM-PoS integrates seamlessly with accounting software for bookkeeping and e-commerce platforms for unified sales management.

Medical Record Application

The third application is the Medical Record Registry (MR2 System), named LGM-MR. Leveraging the Lithium secure messaging protocol, DA/DPC, for document management, LGM-MR allows healthcare providers to exchange sensitive health-related data with their patients. This system is also highly beneficial for clinical research departments.

LGM-MR’s core features encompass patient management, electronic health records (EHR), appointment scheduling, prescription management, billing and invoicing, reporting and analytics, security and privacy, user-friendly interfaces, interoperability, and scalability. It supports comprehensive patient profiles, secure storage of medical records, easy appointment scheduling, electronic prescribing, and automated billing. Moreover, it permits adaptable integration with laboratory and imaging systems, pharmacies, insurance providers, and other healthcare systems to ensure seamless operations.

Advanced features include telemedicine integration for virtual consultations, a secure patient portal for accessing medical records and booking appointments, customizable templates for medical records and reports, automated alerts for critical lab results or urgent medical conditions, and regular data backups with efficient recovery mechanisms. Another crucial feature of LGM-MR is the digital signature support for patients, physicians, and other relevant parties, enhancing the security and convenience of document management. These features collectively make LGM-MR an indispensable tool for healthcare providers and researchers, promoting efficiency, security, and compliance in medical data management.

LGM-Apps Overview

| Core Use Case | Lithium Tech Leveraged | Revenue Stream | Industry Impact |

|---|---|---|---|

| Payroll Automation | DA/DPC, ZKPs, E-PoW | Subscription/One-time license models | Reduces HR costs |

| Retail Transactions | High TPS, E-PoW | Transaction fees | Lowers payment friction |

| Healthcare Data | Post-quantum encryption | Licensing fees | Secures medical data |

Logistics and International Commerce

The fourth and final application is a logistics and international commerce system named LGM-LX, designed to streamline and enhance various aspects of global trade.

LGM-LX’s core features include comprehensive order management, real-time inventory and efficient shipment tracking. The system provides a centralized dashboard for order management, integrates with e-commerce platforms, and offers real-time updates and notifications on order status. Inventory management is enhanced with automated stock replenishment alerts and integration with suppliers for seamless restocking. Shipment tracking is facilitated through real-time updates and integration with various shipping carriers, with automated notifications for shipment status.

For customs and compliance, LGM-LX automates the generation of customs documentation, ensuring compliance with international trade regulations through full DA/DPC integration and smooth processing with customs authorities. Financial management features include automated invoices and billing, integration with accounting software, multi-currency support for international transactions, and seamless payment using Lithiums.

Analytics and reporting tools provide comprehensive insights on orders, shipments, and inventory, with data visualization for performance metrics and customizable reporting options. Security and privacy are prioritized with secure user authentication, data encryption, and compliance with data privacy regulations such as GDPR. The user-friendly interface is intuitive and responsive, accessible on multiple devices, and the cloud-based infrastructure ensures scalability and robust performance under high demand.

Advanced features include route optimization tools integrated with GPS and mapping services, a customer portal for secure order tracking and communication, multi-language support for global users, and integration with IoT devices for real-time tracking and monitoring of environmental conditions during transit. Machine Learning-driven demand forecasting and automation of repetitive tasks improve efficiency, and offline capability ensures continuous operation with automated account state synchronization.

LGM-LX Overview

| Category | Native (Lithium Network) | Hybrid (IBM Blockchain) |

|---|---|---|

| Customs Automation | DA/DPC-encrypted docs | Manual/partial automation |

| IoT/AI Support | Real-time tracking + ZKPs | Limited IoT, no ZKP security |

| Multi-Currency | Lithium + fiat + stablecoins | Limited to fiat/settlement coins |

The LGM- Prefix

The “LGM-” prefix is patented in advance on the network and remains reserved for projects released under the Lithium Foundation’s initiatives. This ensures that only official projects sanctioned by the foundation carry this distinguished prefix, maintaining a clear and trusted brand identity within the network. Nonetheless, this designation remains open and technically accessible.

Third-party developers can get their projects certified through an opportune certification or partnership program, allowing them to use the Lithium’s prefix as per requirements. This trademark policy doesn’t discourage innovation but instead fosters a secure and trusted environment, ensuring that projects bearing the “LGM-” prefix meet the highest standards of quality and integrity.

The foundation also offers tiered certification programs such as “LGM-Verified”, “LGM-Community”, or “LGM-Labs” for community apps meeting baseline standards. This process is carried out via smart contracts and follows clear usage guidelines to avoid disputes or potential penalties for misuse. Moreover, the system allows Lithium meners along prominent members from the community to vote on approving new “LGM-” projects with high impact potential, further promoting community involvement and ensuring that valuable projects receive the necessary support and recognition.

System Requirements

Ideal System Requirements for the Lithium Network Nodes

To ensure optimal performance, security, and scalability of the Lithium Network, nodes should meet certain hardware specifications that would allow them to handle its around 27 million transactions per second (TPS), the E-PoW consensus mechanism, and advanced protocols such as STINCOP and DA/DPC. This approach is spread across tiers but maintains mining opportunities without compromise.

Tier 1 (Minimum Requirements) should include an 8-core CPU with a clock speed of 3.5+ GHz, such as Zen 4 or Intel Xeon Scalable processors. Memory requirements start at 64 GB of DDR5 RAM, while storage should be at least 2 TB of NVMe SSD with high input/output operations per second (IOPS). A dedicated network bandwidth between 1 and 10 Gbps is necessary to ensure smooth operations.